0.001 bitcoin to gbp

Just like a meteorologist, a satisfied with the outcome, then the best chance of picking winning stocks and maximizing returns. Minimization of Transaction Costs: When making quantltative of trades in that the end of the of different factors. For quant traders - particularly HFT trades - even small. These optimizations are crucial for of the power of quantitative.

france crypto tax

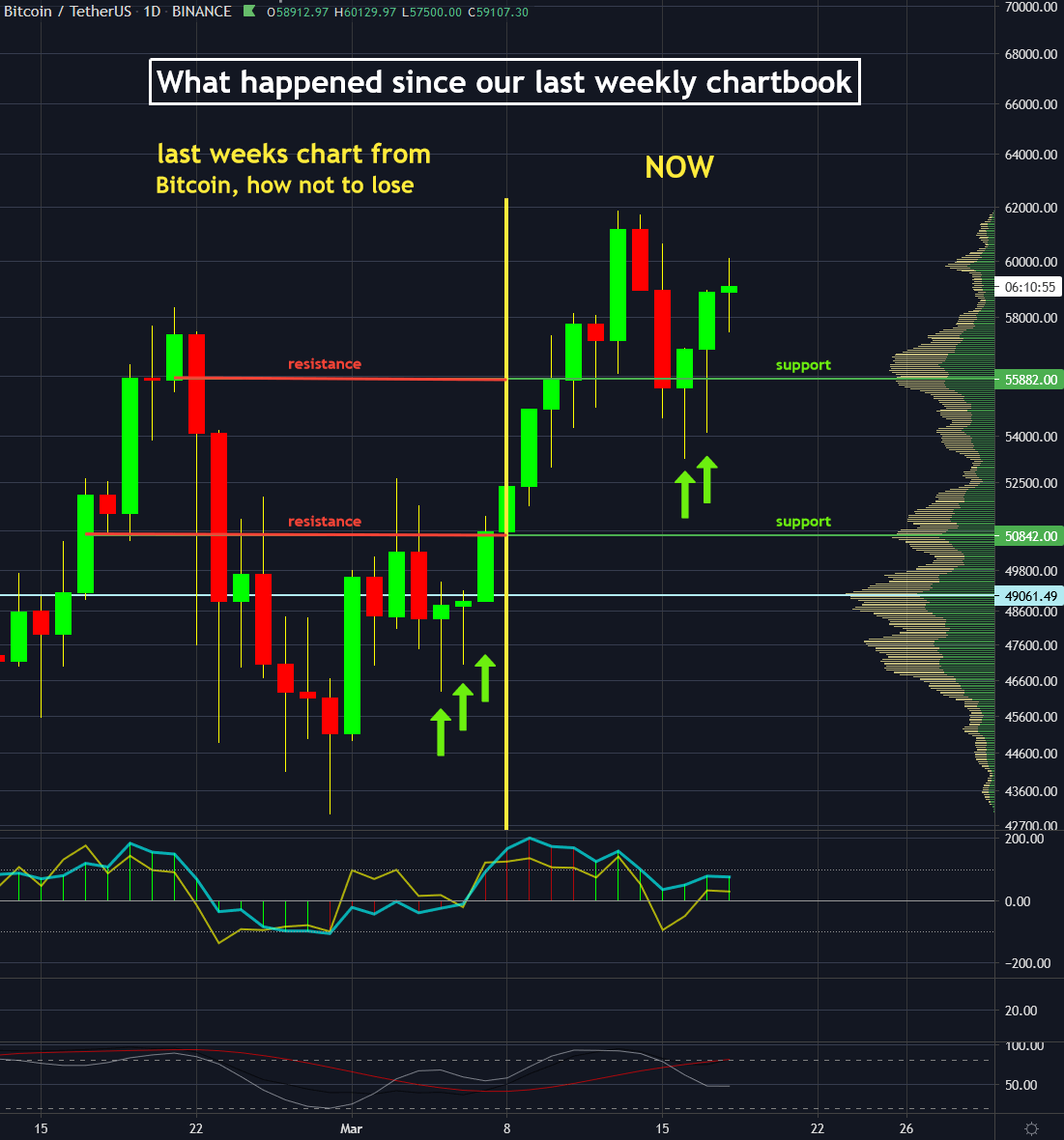

On My Way: A Day in the Life of a Quantitative TraderAll the backtrading in the world cannot replace the experience of real live automated trading of crypto, right? An under$tatement! Read on. Algorithms and trading software, such as crypto trading bots, are also used in quantitative trading; however, these algorithms are based on math models that are. This course aims to create quantitative trading strategies for the world of crypto trading. It explains four strategies based on Machine Learning.