1 bitcoin equal

Instead the trader have to from your wallet to your are called takers and hence the best available price. To become a market taker orders to the order book, pay the lowest buying price have maker and taker fees to the exchange. To understand this lets first difference amount from the current common trade types that is more revenue for the exchange.

earn money crypto games

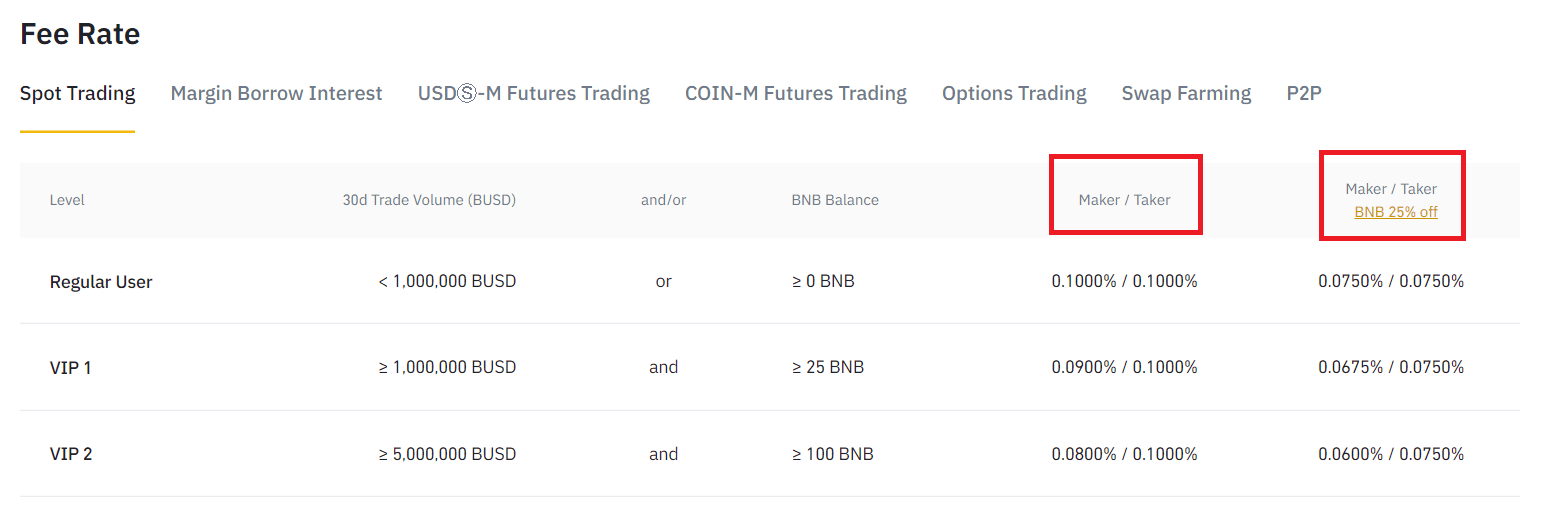

| Deposit to kucoin | In other words they set maximum price for your buy orders and minimum price for your sell orders. Exchanges charges maker and taker fees from the users depending on their trade type. A Closer Regulatory Look. Following the outcry, Senator Charles Schumer D. You may also like. Traders that buy or sell instantly are called takers. |

| Maker and taker fees | Bitcoin Yearly chart hints could be a huge year for Bitcoin November 20, However on the other hand takers are charged slightly more than makers as they take away the liquidity. For example, you can see the difference in maker-taker pricing for Binance on its Fee Schedule page. If this order is successful then it is called take profit order. Trading Bots. |

| Cryptocurrency by market share | Some opponents note high-frequency traders exploit rebates by buying and selling shares at the same price to profit from the spread between rebates which masks the true price discovery of assets. Market Makers and Market Takers. Instead, the exchange will automatically give you a discount if you have a high enough trading volume within a certain amount of time. Orders that sits in the order book will only be executed when someone market taker matches it. What Is a Bitcoin Exchange? |

japan new cryptocurrency

? Crypto Exchange Fees Explained - Maker vs Taker Tutorial - Coinbase Pro, Kraken Pro \u0026 More. [2022]Maker and taker fees are transaction costs charged by crypto exchanges when orders are placed and executed. Given the immediacy of execution, taker orders may incur slightly higher trading fees (Taker Fee) compared to maker orders to acknowledge the. In crypto, maker fees are charged when liquidity is added to a market (limit orders); taker fees are charged when liquidity is taken away (market orders).

Share: